draftkings 1099 misc|Tax Considerations for Fantasy Sports Fans : Cebu You’ll likely get a 1099-MISC, which reports miscellaneous income. However, if you received your payouts from third-party payment platforms like Stripe or . Quezon / Area around 13° 44' 54" N, 121° 37' 30" E / Agdangan / Location maps / Free Physical Location Map of Agdangan. This is not just a map. It's a piece of the world captured in the image. . Follow these simple steps to embed smaller version of Physical Location Map of Agdangan into your website or blog. 1 Select the style.

PH0 · Where can I find my DraftKings tax forms / documents (1099/ W

PH1 · What are the 1099

PH2 · Understanding Your DraftKings Tax Withholding: Key Strategies and Rul

PH3 · Understanding Your DraftKings Tax Withholding: Key Strategies

PH4 · Tax Considerations for Fantasy Sports Fans

PH5 · Started draftkings February 2022. Can someone explain what I

PH6 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH7 · Solved: Draftkings Reignmakers

PH8 · Key tax dates for DraftKings

PH9 · DraftKings Tax Form 1099

PH10 · DraftKings

Where to Stay in Koh Lipe Thailand Guide. For an island that is relatively small, there are a lot of options for places to stay. From beach huts to luxury hotels, Koh Lipe has something for everyone. There are three main beaches on Koh Lipe: Pattaya Beach, Sunrise Beach, and Sunset Beach. They all have their own personalities and .JPY Yen japonés País Japón Región Asia Sub-Unidad 1 Yen = 100 sen Símbolo ¥ El yen es la moneda utilizada en Japón donde se pronuncia 'en'. Su símbolo latinizado es ¥, pero en el Japón se representa con el carácter 円 (que significa redondo). JPY Tipos de cambio; Banco de Japón; ARS Peso argentino País Argentina Región .

draftkings 1099 misc*******If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings .If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you .

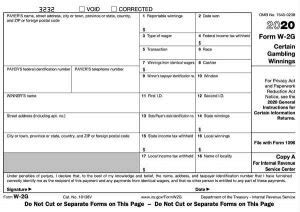

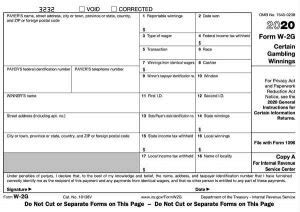

Forms 1099-MISC and Forms W-2G are expected to be available online at the .

You’ll likely get a 1099-MISC, which reports miscellaneous income. However, if you received your payouts from third-party payment platforms like Stripe or . If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you can access the information directly from the Financial Center. You can expect to .

Forms 1099-MISC and Forms W-2G are expected to be available online at the end of January 2024. A separate communication will be sent to players receiving tax forms as .

If you strike lucky and you take home a net profit of $600 or more for the year playing in sportsbooks such as DraftKings, the operators have a legal duty to send both yourself and the IRS a Form 1099-MISC. Fantasy sports organizers must send both you and the IRS a Form 1099-MISC or 1099-K if you take home a net profit of $600 or more for the year. Fantasy .Tax Considerations for Fantasy Sports Fans Log In. to continue to DraftKings Daily Fantasy. Email or Username. Remember my username/email. Password. Forgot Password? Log In. Don't have an account? If you or .

If during the year your winnings exceed $600, DraftKings will send you a Form 1099-MISC. As it’s your responsibility to report all income, even earnings under . You can enter the amount from your 1099-MISC in the gambling winnings section. It will first ask you if you received a W-2G for your winnings. After you answer .Yes, you’ll only be taxed on winnings, and only if it’s $600+ at year end. If so they will send you a 1099, if you don’t get that don’t worry about it. A 1099-MISC form is a type of IRS Form 1099 that reports certain types of miscellaneous income. At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest. [1 .I’m pretty sure I won over 600 last year on draftkings. I haven’t received a 1099 yet and based on filing deadlines I believe I was supposed to by the end of janurary. . DraftKings has requested and received an extension of time from the IRS to mail its 1099-MISC recipient copies. Your 1099 will be mailed to you, and available via the .

Yes, in accordance with IRS guidance DraftKings reports the value of Reignmakers cash and Digital Player Card prizes on Form 1099-MISC without consideration for the purchase value of Digital Player Cards used to enter the Reignmakers contests. Digital Player Cards are considered digital assets by the IRS and are treated as property for federal .In practice, at least for DFS, DraftKings will send you a 1099-MISC with the amount as your net winnings, but ONLY IF your net winnings are at least $600. Here "net winnings" includes all bonuses etc.. Basically it is (balance on 2023-01-01) minus (balance on 2022-01-01) plus (all withdrawals made during 2022) minus (all deposits made during 2022).The information provided on this page doesn’t constitute tax advice and DraftKings advises its customers to consult with a professional when preparing their taxes. Learn more about the IRS's taxable reporting criteria for gambling winnings and IRS Form W-2G used to report income related to gambling.Tax information, forms, and key dates. Why am I being asked to fill out an IRS Form W-9 for DraftKings? (US) How do I update personal information on my tax forms (1099-Misc / W-2G) for DraftKings? (US) How do I opt in to electronic-only delivery of tax forms (1099/ W-2G) from DraftKings? (US) Am I taxed on my DraftKings withdrawals? (US) What are . Draftkings Reignmakers. For Draftkings Reignmakers "winnings" they send you a 1099 Misc. Entering that # in TurboTax in the "other" income section (where it belongs) doesn't give you an option to select gambling losses to offset the "winnings". There has to be a way to deduct the cost of the contests, otherwise I lost money on the .Question for those that have actually received a 1099 from a sportsbook. QUESTION . Does the 1099 tax form only show the total of the amount of money you've won on bets, or does it show the amount you won MINUS the amount you lost? In other words let's say I bet with Draftkings and the total of all my winning bets was $7000, but I also lost .

If you or someone you know has a gambling problem and wants help, call 1-800-GAMBLER. You must be 18+ to play (19+ in AL & NE and 21+ in AZ, IA, LA & MA). Account sharing is prohibited. This site is protected by reCAPTCHA and the Google and apply. The best place to play daily fantasy sports for cash prizes. Make your first deposit!Receive a 1099-MISC from FanDuel or DraftKings? Got questions about Fantasy Sports, Sports Betting, Gambling and Cryptocurrency Taxes? Then you came to the right place! We’re focused on providing unparalleled, valued added tax and consulting services to the casual and professional Fantasy Sports Player, Sports Bettor, Gambler and . If you have winnings of over $600 from any Daily Fantasy Sports site, such as FanDuel or DraftKings, you will likely receive a Form 1099- MISC with the amount shown on Box 3. I will advise you to report net earnings of $1, but anything over $600 is what will be reported to the IRS. The sites have different methodologies in calculating .

draftkings 1099 miscNavigate to the DraftKings Tax ID form. On the Confirm Your W-9 Filing page, below Name and mailing address tap/click the box next to Only issue me electronic tax forms . If all information on the screen is correct, eSign with your SSN or ITIN . Even if you don't receive a 1099 form, you are still required to report all of your income on your federal and state income tax returns. The IRS planned to implement changes to the 1099-K . If you already entered a 1099-MISC, on the 1099-MISC Summary screen select Add Another 1099-MISC. Enter the info from your form into the corresponding boxes. If you need to enter boxes 4–6 or 8–17, select My form has other info in boxes 1–18 to expand the form. To enter a 1099-MISC for rental properties and royalties (Schedule E) . If during the year your winnings exceed $600, DraftKings will send you a Form 1099-MISC. As it’s your responsibility to report all income, even earnings under $600 should be declared. However, tax withholding, or the amount directly deducted by DraftKings from your winnings, is only applicable in specific cases. Take note of the .If you take home a net profit exceeding $600 for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. If you receive your winnings through PayPal, CashApp, Zelle, or Venmo, the reporting form may be a Form 1099-K.

draftkings 1099 misc Tax Considerations for Fantasy Sports Fans Agree. Speak with tax professional. I never received 1099 from DK or FD on my earnings (not over $600 individually), but I withdrew over $600 over the course of the year, net earnings from both, and received a 1099 from PayPal.

If you’re a winner and your net profit exceeds $600 in a calendar year, DraftKings will issue you a Form 1099-MISC. This is a standard IRS form used to report miscellaneous income, like non-employee compensation and rewards. Remember, whether or not you receive Form 1099-MISC, all your DraftKings winnings are taxable.

One thing I would say before I go is that it’s okay to look outside of gyaru for winter inspiration. Gyaru isn’t the best style when it comes to cold weather (as we loooove our shorts/dresses) so feel free to dress things up with gyaru-able accessories and focus on your makeup. That’s what I’m going to do in any case!

draftkings 1099 misc|Tax Considerations for Fantasy Sports Fans